Client Service Center

Client Service Center

Have questions or need assistance with the Upgrade?

Call (850) 907-2303. Our Team is here to help.

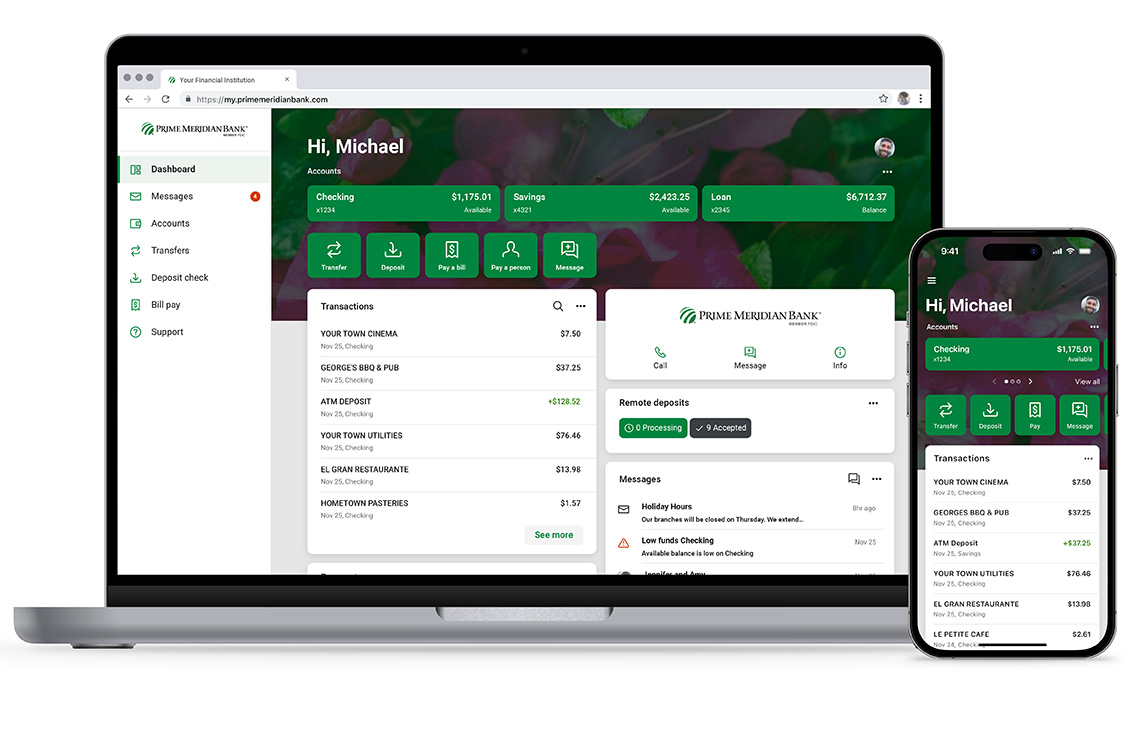

Welcome to an improved digital banking experience for clients that use our Online Banking and Mobile Banking app. Of course you are always welcome to enjoy our exceptional in-person service and in-branch banking. With this upgrade your digital experience will be just as easy and even more convenient!

Be the first to try our new Mobile App

PMB Mobile (the new app) will require downloading. Apple iOS users Click Here (App Store). Android users Click Here (Google Play). Your Username and Password will be required to login and to reset biometrics.

Enjoy these new and enhanced features:

FAQs

{beginAccordion}

When does the upgrade take place?

Our mobile banking app ("PMB Mobile") is available for download and the previous "PMB Mobile Banking" app has been retired as it is no longer supported.

Will I need anything special to upgrade?

It will be important to know or have access to your existing online banking Username and Password. If not, no worries. We will be glad to look up your username for you or reset your password .

Will my saved Username and Password carry over?

No. However, by calling our Client Service Center at (850) 907-2303, one of our qualified Bank teammates will assist you by either resetting or providing new credentials.

What action is required on my part?

Using your online banking Username and Password, login as you normally would on our website or through the PMB Mobile app. Enter your Username and Password, the login screen view will reflect the new “look” and you will receive an email verification to confirm your identity. Upon confirming, a prompt will appear to setup two factor authentication (2FA) … a universal security feature. After establishing 2FA authentication, the upgraded Digital Banking dashboard will display.

Will I need to re-enroll in mobile deposit after the Upgrade?

The re-enrollment process is quick and easy. Simply send a re-enrollment request through online banking and a bank representative will approve the request promptly. Call 850-907-2303 for assistance and we will be glad to walk you through the steps.

Will my saved biometrics settings transfer over? (Face ID & Fingerprint)

No. You will, instead, be asked to enter your credentials and set up Two-Factor Authentication (2FA) preferences. Once complete, you will be prompted to re-enable the option to login using biometrics on your device going forward.

Will my Alerts transfer?

New alert options will be available to establish at the account level and for your debit card(s). It is suggested to make note of your current Alerts prior to July 24, 2023 and we will be glad to show you where to re-establish them after the upgrade. Current alerts will not carry over due to the new alert options available.

Will my old PMB Mobile App work after July 25, 2023?

No. Our previous app is no longer supported. PMB Mobile (the new app) will require downloading. iOS users Click Here (Apple App Store). Android users Click Here (Google Play). Your Username and Password will be required to login and to reset biometrics.

What if I forget my password during the upgrade?

If you need assistance resetting your account Username and Password, a Prime Meridian Bank Client Service representative is available by calling (850) 907-2303 during our normal business hours to assist with resetting this information.

Will my account nicknames transfer over?

Yes. Account nicknames will not change when we upgrade. You will have the ability to change the account nickname(s) if you choose to do so.

I use a third party aggregator app (Quicken, MINT, Plaid, Robinhood, etc.). What steps do I need to take to re-establish my connection?

Please do not hesitate to contact us for information on how to re-establish these connections if needed. It is estimated that connections for Quicken users will be re-established within 7-10 days. Third-party app users may need to re-establish their connection manually once they have upgraded their digital banking.

{endAccordion}